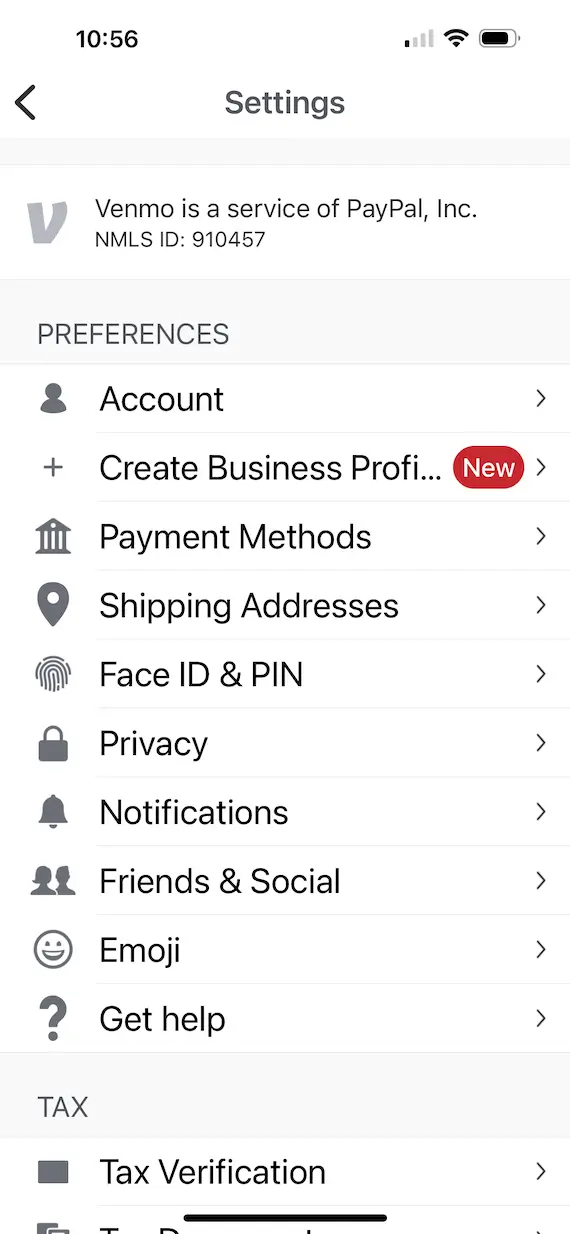

**What Your Venmo Login Session Reveals About Your Financial Security** Wondering what your latest Venmo login says about your financial health? What you access, how often you log in, and your spending patterns subtly paint a picture of your economic stability—especially in a time when financial awareness is rising across the U.S. As everyday transactions shift to mobile and apps become central to managing money, small digital footprints like login habits are gaining attention. People are increasingly curious about how their app behavior reflects opportunity, risk, and readiness—particularly around income reliability, debt awareness, and financial readiness. **Why the Topic Is Gaining Traction in the U.S.** With rising cost-of-living pressures, fluctuating remote work trends, and growing interest in digital financial literacy, examining what your Venmo login history reveals offers insight into personal financial resilience. The App’s ubiquity—outside emails, bills, and peer transfers—makes it a trusted digital window into daily money movement. As users prioritize financial clarity, unexplored signals in login behavior are emerging as subtle yet informative indicators of economic security, sparking broader interest in financial transparency tools. **How Venmo Login Session Data Reflects Financial Security** A Venmo login session includes timestamps, device types, location data, transaction volume, and spending trends—all visible in your active account activity. When reviewed holistically, this data helps assess patterns: consistent logins paired with modest, consistent transactions may indicate steady income and prudent spending. Spikes in activity without clear context might suggest lifestyle inflation or unplanned expenses. Though Venmo doesn’t share full logs with third parties, basic session insights empower users to privately track their financial rhythm—revealing confidence in cash flow, budget discipline, and readiness for surprises. **Common Questions About Your Venmo Login & Financial Health**

**H3: How Do Transaction Patterns Reflect Financial Stability?** Regular, timely logins with predictable spending alignment to income suggest stability. Sudden drops or erratic patterns may signal challenges, though individual circumstances must always be considered. **H3: Can Venmo Login Data Predict Financial Risk?** While logins alone don’t diagnose risk, persistent disconnection or secured device mismatches may prompt security alerts. Responsible users see these as prompts to protect their accounts and adjust habits for stronger financial control. **Opportunities and Realistic Expectations** Understanding your Venmo session insights can inform better budgeting, savvy peer-to-peer payments, and early detection of overspending. Yet, it’s important to remember no app provides a full financial picture—personal context and exercise remain key. Used wisely, session awareness builds confidence and proactive money habits without invasive monitoring. **Common Misunderstandings** Many assume login frequency equates to financial need—but in reality, it’s often lifestyle choice or platform preference. Others fear privacy risks, but Venmo’s user-controlled permissions and encryption prioritize data safety. Trust grows when users realize their login data serves *their* financial education, not external profiling. **Who This Matters For** Whether managing student loans, gig income, household budgets, or urban living expenses, anyone using Venmo regularly can benefit from self-reflecting on transaction habits. Young professionals, parents, freelancers, and recent job transitions all find value in tracking digital financial signals to stay grounded and in control. **Soft CTA: Stay Informed, Stay Empowered** Understanding what your Venmo login session reveals goes beyond numbers—it’s a step toward mindful financial health. Use these insights to ask better questions, adjust habits, and explore tools that support your unique money journey. Be curious, stay informed, and keep growing your financial confidence—one login at a time.

You Won’t Believe What Happens Next at Yeshivaworld—Shock Inside!

You Won’t Believe What Your Yoto Player Underrates Every Time!

This Simple Change Protected Her Mind and Future Beyond What She Imagined