**What is a sovereign wealth fund—and why it’s reshaping global finance** Ever wondered what drives massive global investments behind national coffers? You may be curious about sovereign wealth funds—state-owned investment entities funded by a country’s reserves, often formed from surplus revenues like export earnings or commodity sales. Rarely discussed in casual conversations, these powerful financial institutions are quietly influencing markets, innovation, and long-term economic strategy worldwide. In recent years, interest in sovereign wealth funds has surged, especially across the U.S. market, where economic uncertainty and shifting global power dynamics have sparked broader awareness. These entities manage vast pools of capital—sometimes totaling hundreds of billions of dollars—designed not for short-term gains but for strategic, long-term returns that support national stability and future growth. ### Why What Is a Sovereign Wealth Fund Is Gaining Attention in the US Economic interdependence and market transparency are driving growing curiosity about sovereign wealth funds in the United States. As global markets face volatility and long-term fiscal challenges, these funds represent disciplined capital with large-scale influence. Their investments span infrastructure, technology, real estate, and renewable energy—sectors central to U.S. economic development and innovation.

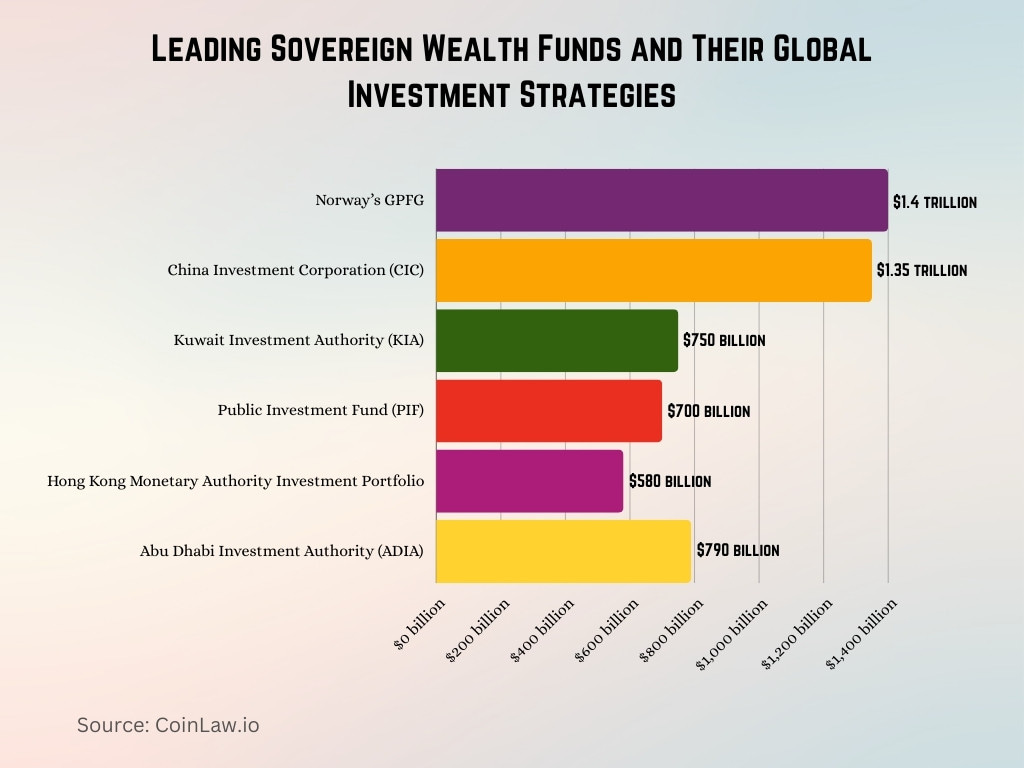

### How Sovereign Wealth Funds Actually Work A sovereign wealth fund is a state-owned investment vehicle funded primarily by foreign exchange reserves, commodity exports, or government revenues. Unlike pension or private investment funds, these entities operate with a long-term mandate—balancing financial returns with national economic goals. They invest globally across asset classes including stocks, bonds, private equity, infrastructure, and real estate. The objective is to grow national wealth sustainably while protecting future generations from economic volatility. Most funds apply transparent governance structures and selective investment criteria to maintain trust and long-term stability. ### Common Questions About Sovereign Wealth Funds **What’s the main purpose of a sovereign wealth fund?** To manage national financial reserves responsibly, generate stable long-term returns, and support economic resilience or strategic industries. **How large are these funds?** Some operate with assets exceeding hundreds of billions of dollars, with investment decisions carefully aligned to national priorities and global market trends. **Do sovereign wealth funds invest in private companies?** Yes, but selectively and often through structured partnerships that balance transparency and strategic expectations. **How do they differ from government pensions?** Unlike public pension plans, sovereign funds are not tied to payouts for citizens; instead, they serve as long-term wealth reserves for national financial health. ### Opportunities and Realistic Considerations Sovereign wealth funds offer unique windows into global economic trends, sustainable investing, and market diversification. Their disciplined long-term approach contrasts with short-term market speculation, providing potential stability in volatile conditions. However, investors should recognize constraints: competitive investment landscapes, regulatory complexities, and limited direct access. Misconceptions persist—especially around political influence or corporate control—yet most funds operate under clear mandates focused on financial prudence and national benefit. ### Separating Myths from Reality Many people assume sovereign wealth funds act as opaque or manipulative financial powers. The truth is, most publish regular reports detailing investment strategies and performance, adhering to international transparency standards. Their influence stems from patience and scale, not sudden market moves. Sovereign funds do not seek to control industries arbitrarily; their investments follow careful due diligence, risk management, and long-term value creation. ### Who Might Care About Sovereign Wealth Funds?

However, investors should recognize constraints: competitive investment landscapes, regulatory complexities, and limited direct access. Misconceptions persist—especially around political influence or corporate control—yet most funds operate under clear mandates focused on financial prudence and national benefit. ### Separating Myths from Reality Many people assume sovereign wealth funds act as opaque or manipulative financial powers. The truth is, most publish regular reports detailing investment strategies and performance, adhering to international transparency standards. Their influence stems from patience and scale, not sudden market moves. Sovereign funds do not seek to control industries arbitrarily; their investments follow careful due diligence, risk management, and long-term value creation. ### Who Might Care About Sovereign Wealth Funds? Anyone invested in global markets, planning long-term wealth, or interested in sustainable economic development may find sovereign wealth funds relevant. Strategists look for resilient investment patterns, while policymakers consider their role in

Anyone invested in global markets, planning long-term wealth, or interested in sustainable economic development may find sovereign wealth funds relevant. Strategists look for resilient investment patterns, while policymakers consider their role in

This x Movie Changed Everything—Getting Them All Streams Now

You Won’t Believe What This Small Trick Does in wp.pl

Unravel the Pure Wurst Meaning No One Talks About